TYPES OF INVESTMENT BANKS: Bulge Bracket Banks, Elite Boutiques, and Middle and Market

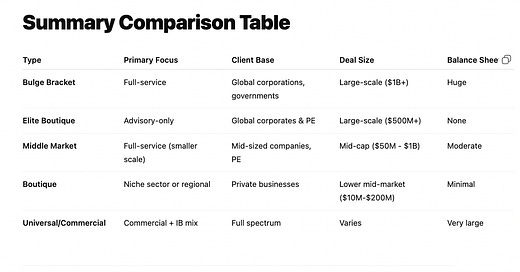

The investment banking world is not a monolith — it’s a highly tiered, diversified ecosystem. Firms vary widely by size, scope, services offered, client base, and business model. Understanding the dis

The investment banking world is not a monolith — it’s a highly tiered, diversified ecosystem. Firms vary widely by size, scope, services offered, client base, and business model. Understanding the distinctions between the different types of banks is crucial for anyone navigating this industry.

1️⃣ Bulge Bracket Banks (The Global Full-Service Giants)

Overview:

The bulge bracket banks sit at the very top of the investment banking hierarchy. These are global, highly diversified financial institutions offering a full suite of services including mergers & acquisitions (M&A), equity and debt capital markets (ECM/DCM), sales & trading, asset management, wealth management, research, private banking, and often consumer and commercial banking as well.

Key Characteristics:

Global footprint (offices across all major financial centers)

Serve Fortune 500 corporations, governments, sovereign wealth funds, and institutional investors

Large balance sheets — can underwrite massive financing deals

Highly structured hierarchy and large teams

Prestige, stability, and significant training resources for employees

Typical Client Work:

Large-scale IPOs and bond issuances

Mega-mergers and cross-border M&A

Sovereign debt advisory

Complex structured products and derivatives

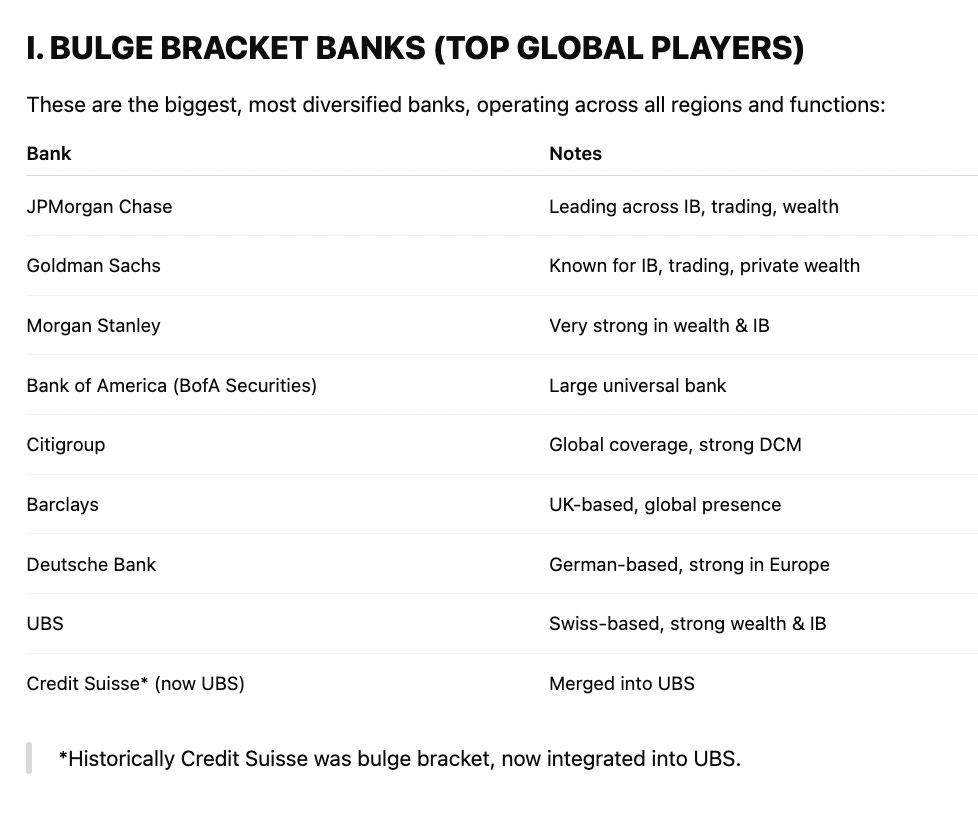

Examples:

JPMorgan Chase

Goldman Sachs

Morgan Stanley

Bank of America

Citigroup

Barclays

Deutsche Bank

UBS

2️⃣ Elite Boutiques (Advisory-Only Specialists)

Overview:

Elite boutique banks specialize exclusively in advisory services — primarily mergers & acquisitions, restructuring, and strategic advisory. They do not typically engage in lending or capital markets activities, allowing them to position themselves as independent, conflict-free advisors.

Key Characteristics:

Highly specialized in M&A and restructuring

Do not use their own balance sheet for lending

Generally smaller, more nimble deal teams

Often pay very competitively at the junior and senior levels

Work on some of the largest, most complex transactions despite smaller firm size

Highly selective hiring

Typical Client Work:

Complex M&A advisory (hostile takeovers, spin-offs, cross-border deals)

Restructuring & distressed advisory

Independent fairness opinions

Corporate defense advisory

Examples:

Evercore

Lazard

Centerview Partners

PJT Partners

Moelis & Co.

Houlihan Lokey (especially in restructuring)

Perella Weinberg Partners

Rothschild

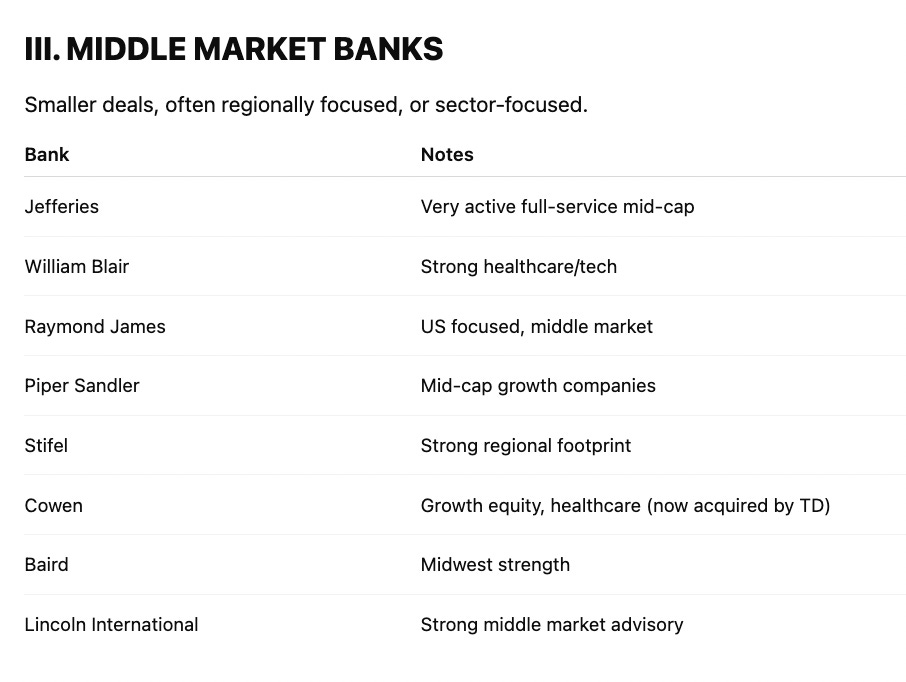

3️⃣ Middle Market Banks (Full Service, Mid-Cap Focused)

Overview:

Middle market banks occupy the "middle ground" — they offer a broad range of services like the bulge brackets, but typically focus on smaller deal sizes and often specialize in certain industries or regions. Many of these firms have strong relationships with private equity sponsors and closely held private companies.

Key Characteristics:

Deal size usually ranges from $50 million to a few billion dollars

Often maintain industry specializations (healthcare, tech, consumer, industrials, etc.)

Work closely with private equity, family-owned businesses, and mid-market corporates

Tend to have flatter hierarchies than bulge brackets

Typical Client Work:

Private company sales (sell-side advisory)

PE portfolio company M&A

Mid-market IPOs and debt issuances

Fairness opinions for sponsor-backed deals

Examples:

Jefferies

William Blair

Raymond James

Piper Sandler

Stifel

Baird

Cowen

Lincoln International

4️⃣ Regional & Boutique Banks (Niche Players)

Overview:

These smaller, often privately held banks focus on very specific sectors, geographies, or client types. They are highly relationship-driven and usually serve private company owners, founder-led businesses, and lower-middle-market private equity sponsors.

Key Characteristics:

Highly specialized expertise in specific industries

Focus on long-term client relationships

Often provide personalized, founder-level access to clients

Lower transaction volume but highly targeted deal work

Typical Client Work:

Founder-led business sales

Private equity sponsor advisory

Sector-specific buy-side mandates

Lower middle-market deals ($10M-$200M range)

Examples:

Harris Williams (PE sell-side specialist)

Capstone Partners

Brown Gibbons Lang (BGL)

Stephens Inc

Solomon Partners

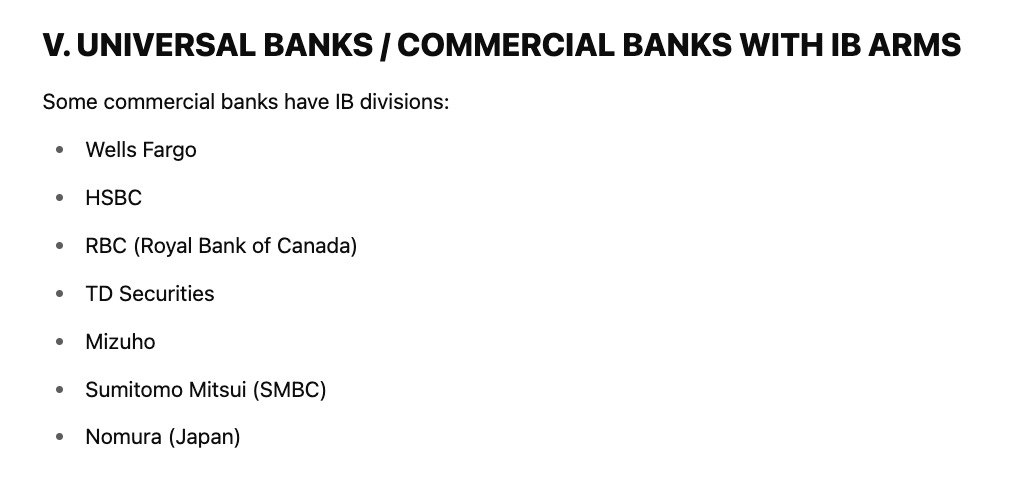

5️⃣ Universal / Commercial Banks with IB Divisions

Overview:

These banks blend commercial banking, consumer banking, and investment banking under one roof. While they may not have the same pure investment banking prestige as the bulge bracket names, they offer the advantage of deep client relationships across multiple products (lending, cash management, trade finance, etc.), giving them strong cross-sell capabilities into capital markets and advisory services.

Key Characteristics:

Full suite of commercial and consumer banking products

Large balance sheets, allowing extensive lending capabilities

Cross-sell IB services to corporate lending clients

Often dominant in their home markets

Typical Client Work:

Debt financing

Loan syndications

Mid-market IPOs

Mid-cap advisory

Examples:

Wells Fargo

HSBC

RBC (Royal Bank of Canada)

TD Securities

Mizuho

SMBC

Nomura