The 200M Dollar Mistake VCs Make (Data Inside)

What if I told you that selling too late could be costing early-stage VCs large sums?

Charles Hudson just proved it with cold, hard numbers.

The Precursor Ventures founder recently closed his fifth fund—a 66M early-stage vehicle. He thought he was done with surprises.

Then one of his LPs dropped a question that changed everything:

"What if you had exited every single portfolio company at Series A? Series B? Series C?"

Most fund managers would dismiss this. Hudson didn't.

He crunched the numbers. What he discovered will make you question everything you think you know about exit timing.

The Series A Trap That's Killing Returns

Hudson's first finding? Exiting at Series A was a disaster.

Sure, you'd cut your losses on the dogs. But you'd also walk away from your 10x top picks right before they exploded.

The math was brutal: early exits murdered fund results because they severed the compounding power of breakout companies.

But Series B? That's Where It Gets Interesting...

This is where Hudson's analysis gets wild:

If he had systematically exited every stake at Series B, his fund would have returned over 3x.

Let me repeat that: 3x returns. From a seed-stage fund. By selling "early."

"You could have a north of 3x fund if you sold everything at the B," Hudson admitted. "And I'm like, 'Well, that's pretty good.'"

The Data Behind Series B Exits

Recent market analysis supports Hudson's findings with compelling statistics:

Market Trends by Exit Stage (2024):

Companies exiting at Series A/B: 90 percent of total exit activity

Series B median valuation: 105M

Typical Series B revenue multiple: 8-15x

Average holding period from seed to Series B: 3-4 years

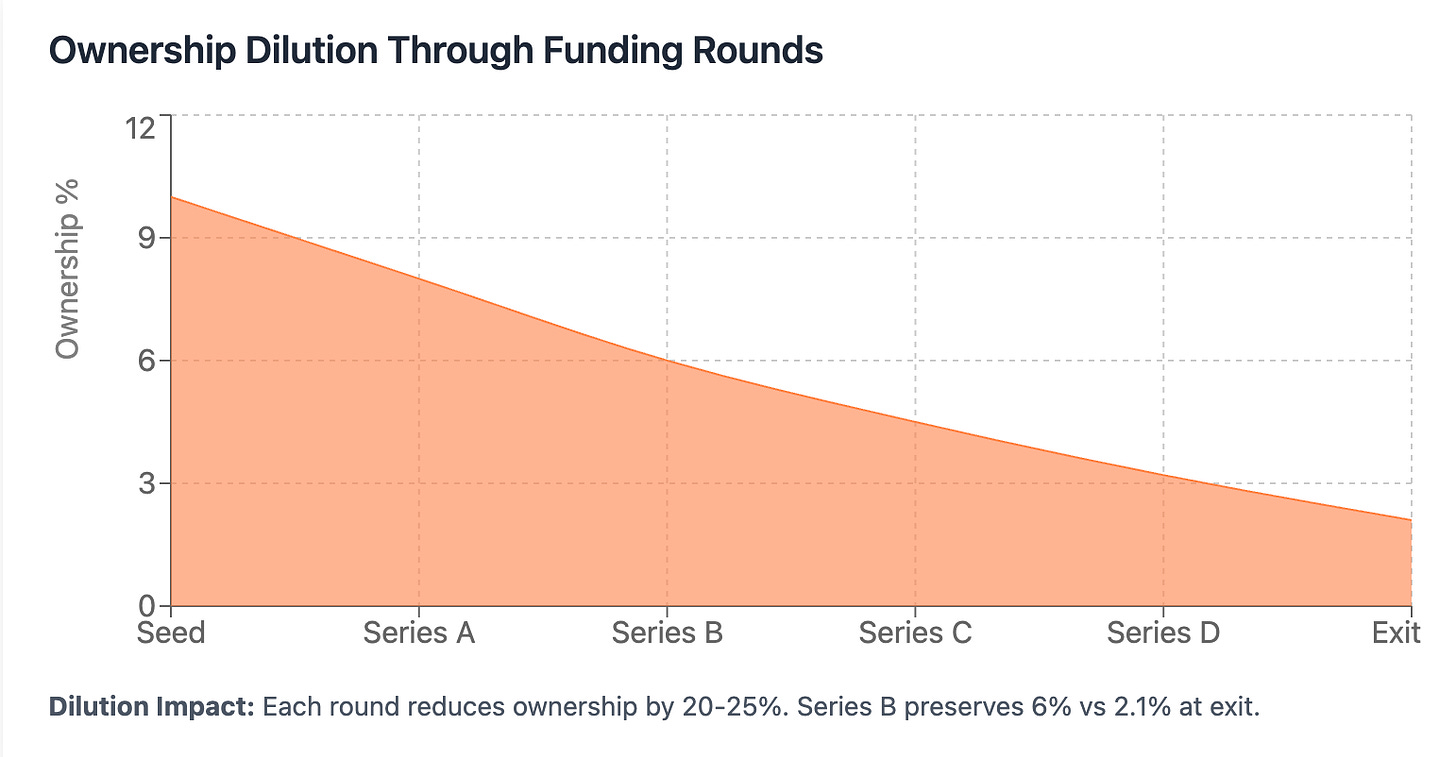

The Dilution Reality: Research analyzing over 5,000 cap tables shows that early investors face approximately 20-25 percent dilution at each subsequent funding round.

This means:

Seed investors retain

~75 percent after Series A

~56 percent after Series B

~42 percent after Series C

~32 percent after Series D

Exit Multiple Analysis: While VCs typically target 10x returns, the reality varies significantly by exit timing:

Series A exits: Often premature, missing major value creation

Series B exits: Sweet spot of 3-8x returns with reduced risk

Series C+ exits: Higher absolute returns but increased dilution and market risk

Why This Changes Everything

Think about what this means:

No more betting the farm on IPO moonshots

No more watching Series D dilution destroy your ownership

No more praying your top pick survives the next sector crash

Series B exits provide something most VCs crave but rarely achieve: predictable exceptional returns.

The Subtle Genius Behind This Strategy

This isn't just about timing—it's about mathematics.

By Series B, you've identified your top picks. Sector validation is real. Revenue is growing.

But you haven't yet reach a cap where returns are constrained.

For micro-VCs without deep pockets for follow-on rounds, this could be the difference between a good fund and a legendary one.

Being Data Driven

Hudson's transparency in this case is rare. Most GPs would bury analysis that questions their "hold forever" strategy.

But the savviest backers are already asking: What if conventional wisdom is wrong?

What if the real alpha isn't in picking top picks—but in knowing exactly when to sell them?

The Question Every GP Should Ask

Hudson's LP didn't just ask a question. They revealed a blind spot that could be costing the entire industry billions in unrealized alpha.

How many other "obvious" venture strategies are actually destroying returns?

And more importantly: Are you brave enough to test your assumptions with data?

Preparing for Opportunities Like This

Strategic insights like Hudson's don't just happen. They require the kind of analytical rigor and sector fluency that separates top-tier investors from the rest.If you're committed to understanding these dynamics—or stepping into roles where you're making these exact decisions—you need more than theory.

You need real preparation.

How Sutton Capital Helps You Navigate the Private Sectors

Breaking into Private Equity and Venture Capital at organizations like Goldman Sachs or Precursor Ventures takes more than technical know-how.

It demands strategic positioning, sector fluency, and the ability to communicate your edge effectively.That's where we come in.

At Sutton Capital, we support ambitious professionals through:

✅ Tailored career roadmaps for PE & VC pathways

✅ Hands-on case studies & project-based learning modules

✅ Interview & presentation coaching for high-stakes roles

✅ Connections to a trusted network of mentors, professionals, and operators

We’ve helped professionals step into roles like this—often within 30 to 60 days.

📅 Ready to advance into Private Sectors?

👉 Schedule a Personalized Planning Session with Our Team

To Your Growth,

The Sutton Capital Team